Overview

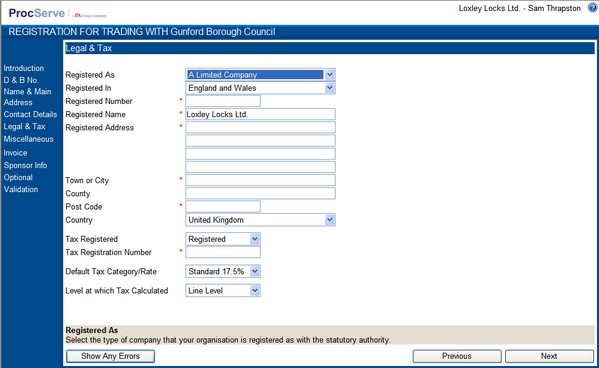

The Legal & Tax page enables you to supply the following information about your company:-

| • | Whether your organisation is registered as a company with a statutory authority and, if so, the registered details. |

| • | Whether your organisation is registered for tax and, if so, to record the Registration Number and other tax configuration. This is particularly important for suppliers that will be transmitting invoices to buying organisations. |

The Legal & Tax page looks like this:

Data Entry

![]() This field is a drop-down list of types of company registration and a "Not Registered" option. Select type of company registration that your organisation has with the statutory authority or select the "Not Registered" option.

This field is a drop-down list of types of company registration and a "Not Registered" option. Select type of company registration that your organisation has with the statutory authority or select the "Not Registered" option.

NOTE: If the "Not Registered" option is selected, the other data fields for recording registration details will no longer be displayed.

![]() This field is a drop-down list of countries. Select the name of the country that your organisation is registered in.

This field is a drop-down list of countries. Select the name of the country that your organisation is registered in.

![]() This field should contain the number assigned to your organisation by the statutory authority.

This field should contain the number assigned to your organisation by the statutory authority.

![]() This field should contain the registered name of your organisation.

This field should contain the registered name of your organisation.

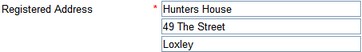

These fields should contain the building name or number, street name and district of the registered address of your organisation.

These fields should contain the building name or number, street name and district of the registered address of your organisation.

![]() This field should contain the town or city part of the registered address.

This field should contain the town or city part of the registered address.

![]() This field should contain the county, province or state of the registered address.

This field should contain the county, province or state of the registered address.

![]() This field should contain the postal code of the registered address.

This field should contain the postal code of the registered address.

![]() This field is a drop-down list. The country for your registered address should be selected, if not the one displayed.

This field is a drop-down list. The country for your registered address should be selected, if not the one displayed.

![]() This field is a drop-down list with options of "Registered" or "Not Registered". If your organisation has been registered for tax (e.g. VAT) the "Registered" option should be selected.

This field is a drop-down list with options of "Registered" or "Not Registered". If your organisation has been registered for tax (e.g. VAT) the "Registered" option should be selected.

NOTE: If the "Not Registered" option is selected, the "Tax Registration Number", "Default Tax / Category Rate" and "Level at which Tax Calculated" fields will no longer be displayed.

![]() This field should contain the number assigned to your organisation by the tax authority.

This field should contain the number assigned to your organisation by the tax authority.

![]() This field is a drop-down list. It is used to select the default rate of tax that will be applied to the lines of a document created within the Supplier Portal e.g. invoices, credit notes. Choose the rate that is most commonly applied to sales. This default value can be changed for particular documents when they are created and edited.

This field is a drop-down list. It is used to select the default rate of tax that will be applied to the lines of a document created within the Supplier Portal e.g. invoices, credit notes. Choose the rate that is most commonly applied to sales. This default value can be changed for particular documents when they are created and edited.

![]() This field is a drop-down list with two options: "Line Level" and "Document Level". Select whether tax is calculated at line or document level for any new documents created within the Supplier Portal e.g. invoices, credit notes. If "Line Level" is selected the tax is calculated line by line and the tax values are then summed to derive the tax value for the document. For document level calculation the net values of taxable document lines are summed and the tax value for the document is calculated from the summed line value(s).

This field is a drop-down list with two options: "Line Level" and "Document Level". Select whether tax is calculated at line or document level for any new documents created within the Supplier Portal e.g. invoices, credit notes. If "Line Level" is selected the tax is calculated line by line and the tax values are then summed to derive the tax value for the document. For document level calculation the net values of taxable document lines are summed and the tax value for the document is calculated from the summed line value(s).

NOTE: All data entry fields highlighted with a * are mandatory and cannot be left blank.

NOTE: As you enter data in field, additional help is displayed in the area at the bottom of the page e.g.

![]()

Use the Navigation Buttons to verify the data entered or to progress through the registration process.